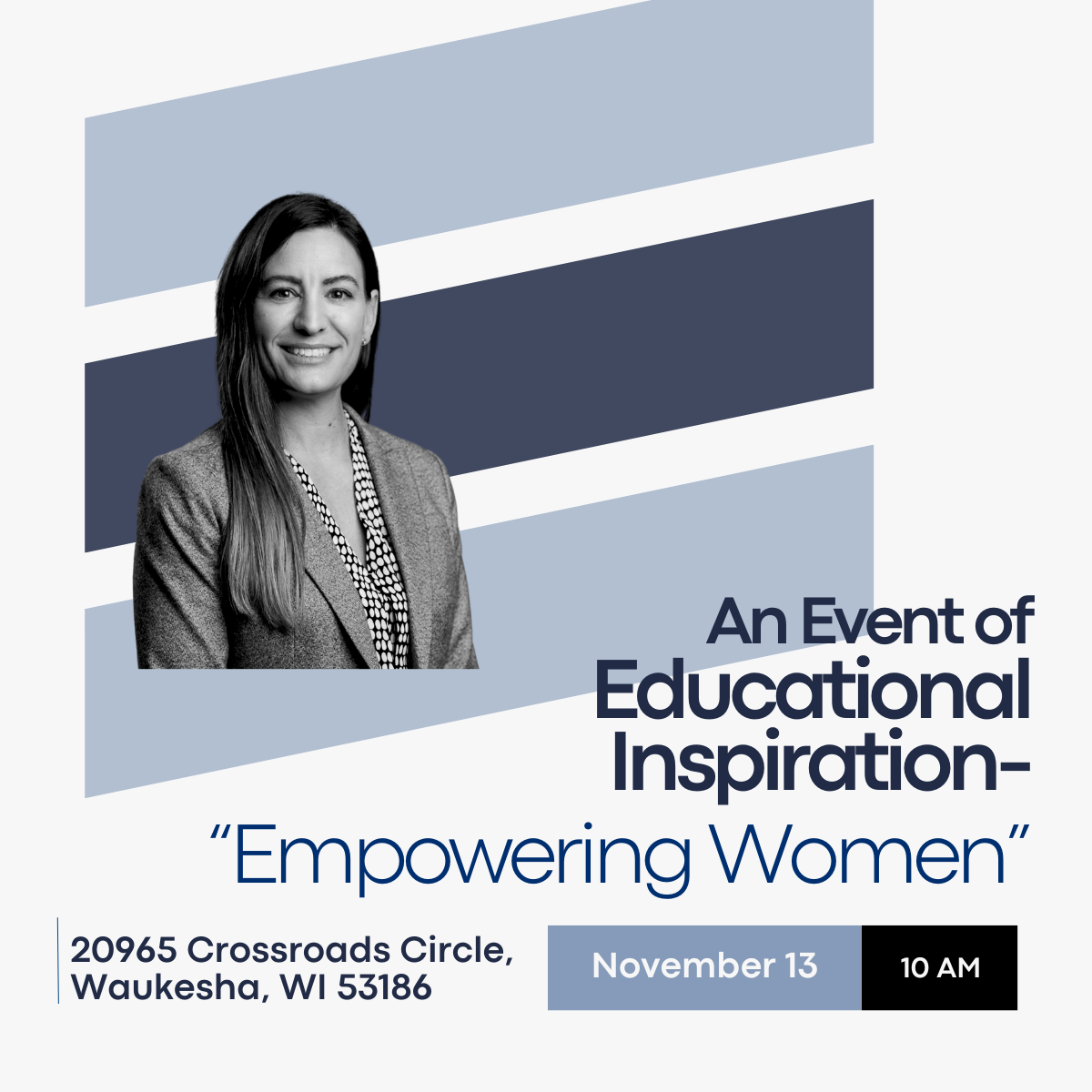

Meet Your Host: Tina Alfini, CDFA®

Tina Alfini, CDFA®, originally from the Chicago area, has called Wisconsin home since graduating from the University of Wisconsin–Madison with a degree in Education. After teaching in Milwaukee and Lake Country, she focused on raising her two sons, Michael and Dylan, while pursuing certifications in holistic health and wellness as a nutrition coach, personal trainer, yoga, and group fitness instructor.

With a holistic approach, Tina transitioned to financial and retirement planning with Drake and Associates.Licensed in insurance and securities since 2017 and a Certified Divorce Financial Analyst (CDFA®) since 2020, Tina is passionate about educating clients to confidently navigate significant life changes.

Outside of work, Tina enjoys spending time with family and friends, dancing to live music, being active outdoors, and teaching yoga and meditation. In the summer, you'll find her doing stand-up paddleboard yoga on Pewaukee Lake.